Intel spin off mobileye mobileye acquired by intel why did intel buy mobileye does intel own mobileye mobileye an intel company intel and mobileye acquisition mobileye acquired by intel why did intel buy mobileye intel shareholders getting stock in mobileye will intel shareholders get mobileye stock intel stock price intel support assistant

Intel's Mobileye Expands Self-Driving Car Tests, so You Can Buy One in 2025

What's happening

Mobileye, Intel's car tech subsidiary, has started testing its self-driving cars in Miami and Stuttgart, Germany, so it can train its AI to cope with more road conditions.

Why it matters

Autonomous vehicles promise to revolutionize transportation -- if engineers can make them safe and smart enough. Real-world road testing is crucial to this.

What's next

Mobileye will expand tests to more cities with an expectation that consumers can buy cars with its self-driving technology in 2025.

Intel's Mobileye subsidiary has begun testing its autonomous vehicles in Miami and Germany to help build self-driving cars that can handle a variety of factors, such as weather conditions, urban layout, traffic signals and driving styles.

Tests in Miami will help Mobileye gather information on how vehicles handle heavy rains, such as those the city often experiences, Mobileye said Wednesday. The tests in Stuttgart, Germany, will similarly help Mobileye learn how the technology handles snow and hills. The cars will traverse everything from rural and suburban areas to Miami's highways and Stuttgart's high-speed autobahns.

"One of the reasons why we are looking at all of these cities is we believe that for AVs to be available ubiquitously, eventually, they have to work broadly," said Johann "J.J." Jungwirth, vice president of Mobileye's mobility service work. "We'll expand further into other cities in the US."

Mobileye's tests are part of its efforts to get self-driving shuttles on the road by 2023 and self-driving cars for consumers on the road in 2025. Doing so will help the Israel-based subsidiary, which is already a top supplier of cameras, chips and software for advanced driver assistance systems that help human drivers with tasks like emergency braking or staying in a lane. The subsidiary is hoping to expand further into sensors and computer systems that completely pilot a vehicle, a more challenging field of research.

Autonomous vehicles could radically overhaul transportation. Proponents say it could improve safety because people are notoriously easy to distract. It could also allow commuters to nap or work. Testing, however, has taken years as engineers have discovered that the complexities of real-world driving are harder to tackle than initially thought.

"If you'd asked me in 2016, I'd have said we'll have autonomous vehicles by 2020," said Carla Bailo, chief executive of the Center for Automotive Research. "There were so many things we didn't know."

Mobileye is already testing autonomous vehicles in Jerusalem, Detroit, Tel Aviv, Paris and Munich and has run smaller tests in New York City and Shanghai. Its existing ADAS cameras, built into models from Volkswagen, BMW, Toyota and others, also gather mapping data that is instrumental to the subsidiary's autonomous push. The system not only spots traffic signals and lane stripes but also tracks human drivers' routes through intersections and logs where they apply brakes and turn signals, Jungwirth said.

"Last year we received data for 4.1 billion kilometers worldwide," or about 2.5 billion miles of road mapping data, he said. "It's an exponential curve. We believe we'll be above 20 billion kilometers by 2024."

Intel acquired Mobileye in 2017 and plans to hold an initial public offering for its stock in 2022. Even after the IPO, though, Intel plans to keep a majority stake in Mobileye.

Level 4 autonomy, in which a vehicle drives with no human intervention or oversight within a limited geographical area, is already a reality in some pockets of the world as companies test robotaxis. Alphabet's Waymo leads in Level 4 technology, with more autonomous miles driven and more operations with no human oversight, Bailo said. General Motors' Cruise unit is in second place. Tesla has Level 2 autonomy, which requires human oversight and has thousands of customers testing it to refine its functions.

Mobileye plans to sell components to automakers and to operate its own robotaxi fleet. The company is working on a new AI chip called EyeQ Ultra for processing the flood of data from autonomous vehicles' cameras, lidar laser scanners and radar systems. There, its competitors include AI chip giant Nvidia and Qualcomm, a newer player that lured BMW away from Mobileye.

"Mobileye is ahead in ADAS, where it has the largest share, but its attempt to move up to be a leader in autonomous driving is in some ways lagging," said processor analyst Mike Demler. "Nvidia has the clear advantage in high performance."

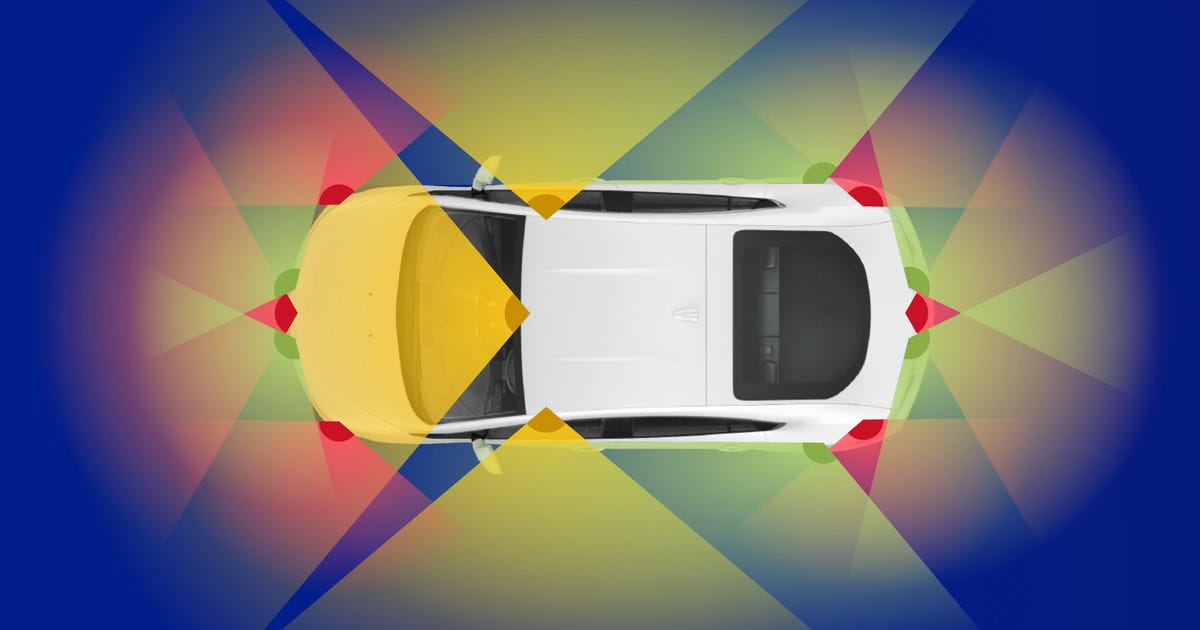

Intel's Mobileye subsidiary uses two systems for piloting its autonomous vehicles, one with cameras and another with radar and lidar (laser) sensors, shown here. Red means radar, yellow means long range lidar and green means short range lidar.

Intel MobileyeOne hot area autonomous technology development is the sensors that cars use to see around them. Tesla is unusual in using cameras alone, a design that's cheaper and means sleeker cars. Most autonomous vehicle makers, though, pair cameras with radar and lidar sensors.

Mobileye has two independent systems for judging how to pilot an autonomous car, one with cameras and the other combining radar and lidar. Each is designed to pilot the car fully on its own. If either system concludes there's a safety problem, the car will try to avoid it, regardless of whether the other system agrees, Jungwirth said.

Richard Wallace, an analyst with HWA Analytics, approves of the approach. "If we look at safety as the primary goal, then as much redundancy as one can afford is the only thing that makes sense," he said. "That means every type of sensor."

Source

Blog Archive

-

▼

2022

(203)

-

▼

November

(56)

- SoftBank And Nvidia Call Off $40 Billion Deal For Arm

- Twitter Bans Climate Change Denial Ads

- Ken Block's Hoonipigasus Is A 1,400-HP Porsche 911...

- Intel Upgrades Quantum Computer Ambitions With New...

- Save Hundreds On Recent IPhone And Apple Watch Mod...

- 'God Of War' TV Show Adaption Might Be Heading To ...

- Facebook, Twitter, TikTok Receive Failing Grades O...

- Hyundai Is Spending $5.5 Billion To Build EVs, Bat...

- Met Gala 2022: Start Time Tonight, Theme And How T...

- 2023 Genesis GV60 Is A Futuristic EV

- The Xiaomi Mi Band 5 Fitness Watch Just Dropped To...

- RedMagic 7: A Little Bit Android, A Little Bit Nin...

- Satellite Snaps Wowza Space Selfie With Off-the-Sh...

- The School-friendly Lenovo 100E Chromebook Is Just...

- What To Do If A Loved One Asks To Borrow $1,000

- Democrats Propose $100 Monthly Gas Stimulus To Com...

- 11 Last-minute Gifts You Can Give To Kids Of Any Age

- Netflix Lays Off Workers From Its Tudum Fandom Web...

- Wall-size, Million-dollar MicroLED TVs Point To Th...

- LG Delivers A 32-inch OLED Monitor... If You Want ...

- Wordle Is Being Released As A Board Game In October

- 'Paper Girls' Review: Newsies Vs. Terminator, But ...

- Lenovo Legion 2 Gaming Phone To Sport Four Ultraso...

- Android 13 Has Arrived On Google Pixel Phones

- GoPro Hero 10 Black Review: Pushing Boundaries Onc...

- Great Father's Day Gifts For Soon-to-Be Dads

- 9 Great Reads From CNET This Week: Extinction, Air...

- Sony Confirms 'Venom 3' And 'Ghostbusters: Afterli...

- Eufy Video Doorbell Dual Review: Are 2 Cameras A G...

- Intel's Mobileye Expands Self-Driving Car Tests, S...

- Snapchat's Augmented Reality Lenses Can Span Whole...

- 2021 Tesla Model Y Review: Nearly Great, Criticall...

- Microsoft's Surface Laptop Studio Is $300 Off Toda...

- Over $3M Has Been Spent On GameStop's NFT Marketplace

- 3D-Print Your Face On Star Wars And Disney Action ...

- How To Clean Your Mattress At Home

- 'Hey Facebook, Take A Photo': The Social Network's...

- How To Download Wordle And Play Offline For The Ne...

- MacBook Pro 16-inch: Bye-bye Butterfly Keyboard

- Best Black Friday Deals Available Now: 4K TVs, Bea...

- Apple's 2022 IPhone SE Has 5G And A New Chip. But ...

- War In Ukraine Brings Out Scammers Trying To Explo...

- Netflix Aims To Start Charging You For Password Sh...

- I Used Loop To Hack My Insulin Pump To Better Cont...

- See How Easy The GoPro Omni Makes Shooting 360 VR ...

- The Coolest Gaming Gadgets We Saw At CES 2018

- AI Helps The Powerful But Harms The Vulnerable, Mo...

- Xiaomi's Mi 10T Pro 5G Has A Super Smooth 144Hz Di...

- Xiaomi Mi Notebook Air Review: Xiaomi's $750 Lapto...

- Lenovo Glasses T1 Are Wearable Displays That Also ...

- Mario Strikers Trailer Shows Off Chaotic Soccer Ac...

- 2021 Ford Escape Plug-In Hybrid Review: Unexciting...

- HexClad Review: A Hybrid Stainless Steel Nonstick ...

- 2023 Acura Integra Review: Exactly What It Should Be

- Meet Moog's Music Machines, Made In America

- How To Control Your GoPro With Your Apple Watch

-

▼

November

(56)

Total Pageviews

Search This Blog

Popular Posts

-

Contoh skripsi, contoh skripsi perpajakan, contoh skripsi pdf, contoh skripsi keperawatan, contoh skripsi pgsd, contoh skripsi e learning, c...

-

Contoh discussion text about handphone samsung, contoh discussion text about handphone terbaru, contoh discussion text about handphone acces...

-

Contoh form data karyawan, contoh form data karyawan baru, contoh formulir, contoh formulir kesediaan, contoh formulir bahasa inggris, conto...